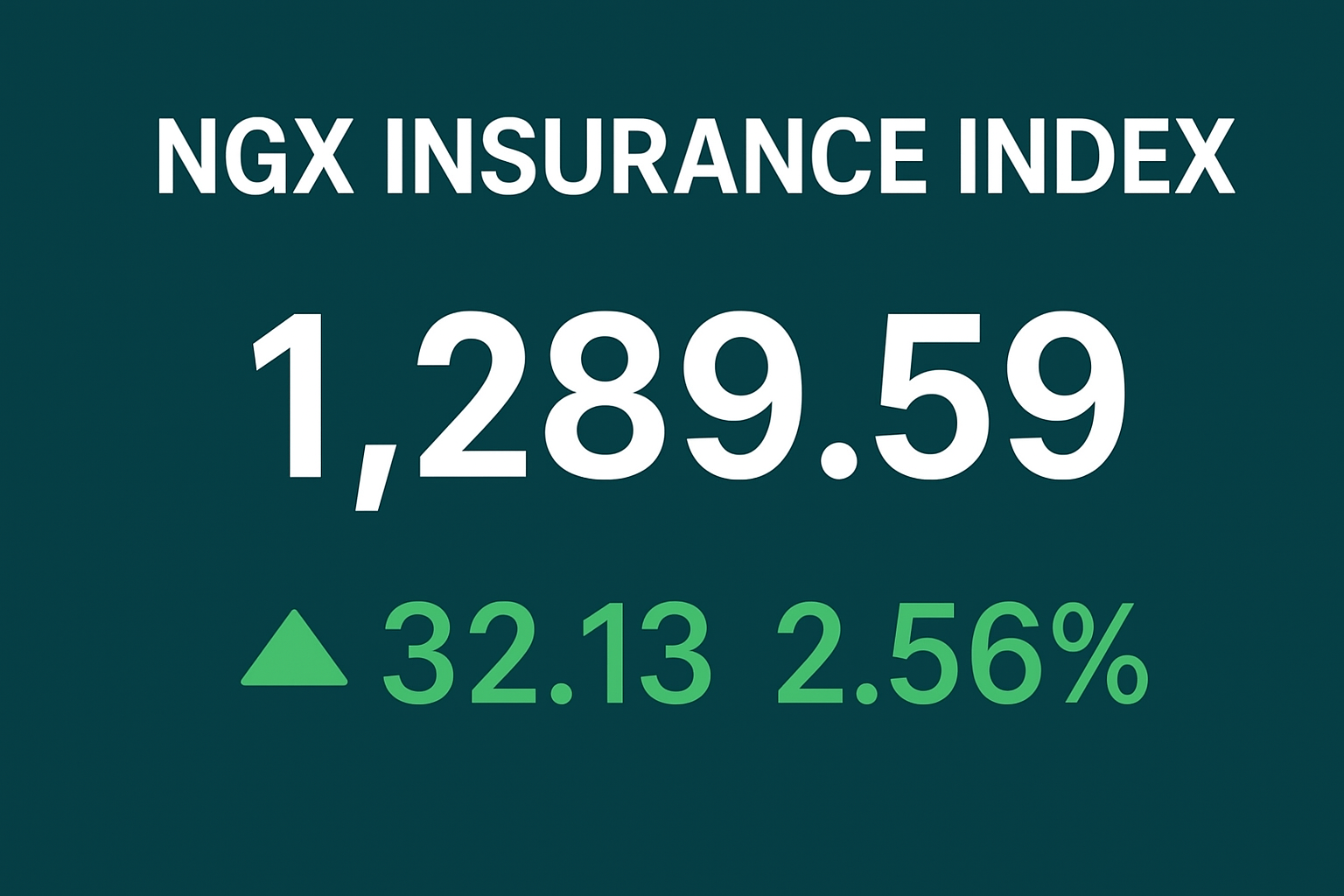

The Nigerian insurance sector, once dismissed as a “sleeping giant,” stormed back into investor focus with a remarkable 1.49 billion units traded in the most recent market session. The surge, marked by sharp gains in several counters and massive volume on a few heavyweights, signaled renewed confidence in the industry’s future and its potential role in driving Nigeria’s economic growth.

The Nigerian insurance sector, once dismissed as a “sleeping giant,” stormed back into investor focus with a remarkable 1.49 billion units traded in the most recent market session. The surge, marked by sharp gains in several counters and massive volume on a few heavyweights, signaled renewed confidence in the industry’s future and its potential role in driving Nigeria’s economic growth.

A Billion-Unit Frenzy

Leading the rally was Sovereign Trust Insurance Plc, which dominated the market floor with an astonishing 1.41 billion shares traded—a figure that dwarfed activity across the entire sector. This outsized liquidity push not only placed Sovereign Trust in the spotlight but also reshaped perceptions of how much attention insurance stocks could attract from both institutional and retail investors.

Other major players also made strong showings. AIICO Insurance Plc, with a market cap of ₦127.7 billion, rose 9.75% to close at ₦3.49, backed by a robust trade of 11.6 million shares. AXA Mansard Insurance Plc, one of the sector’s most diversified names, delivered a near-maximum gain of 9.94%, while Cornerstone Insurance Plc surged 9.62%, adding further momentum.

Top Gainers: Bulls Take Control

Several stocks lit up the insurance board with near-double-digit gains, reflecting the bullish sentiment that swept through the sector.

| Company | Closing Price (₦) | % Change |

|---|---|---|

| Veritas Kapital Assurance Plc | 1.98 | +10.00% |

| AXA Mansard Insurance Plc | 15.82 | +9.94% |

| Prestige Assurance Plc | 1.78 | +9.88% |

| SUNU Assurances Nigeria Plc | 5.50 | +9.78% |

| Cornerstone Insurance Plc | 7.18 | +9.62% |

These gains were broad-based, showing that investor interest went beyond the biggest firms to touch mid-tier and emerging players.

Volume Leaders: Sovereign Trust Leads the Pack

The day’s story was also about sheer trading activity. Beyond Sovereign Trust’s billion-plus shares, other insurers saw notable action.

| Company | Volume Traded | Trades |

|---|---|---|

| Sovereign Trust Insurance Plc | 1,416,633,778 | 124 |

| Universal Insurance Plc | 24,154,245 | 229 |

| Mutual Benefits Assurance Plc | 8,931,940 | 217 |

| LASACO Assurance Plc | 6,430,690 | 114 |

| Coronation Insurance Plc | 5,947,946 | 109 |

The activity reflects a mix of institutional accumulation and retail speculation, pointing to a sector that is no longer ignored by traders.

Notable Laggards: The Quiet Counters

Not every insurer joined the rally. A handful of companies remained flat or inactive, highlighting the uneven nature of the sector’s recovery.

| Company | Closing Price (₦) | % Change | Volume |

|---|---|---|---|

| NEM Insurance Plc | 31.20 | 0.00% | 263,064 |

| Regency Assurance Plc | 1.30 | 0.00% | 0 |

| Fortis Global Insurance Plc | 0.20 | 0.00% | 0 |

| International Energy Insurance | 3.34 | 0.00% | 0 |

| Staco Insurance Plc | 0.48 | 0.00% | 0 |

These laggards underscore that while momentum is building, challenges remain for insurers struggling with weak governance, liquidity constraints, or legacy issues.

Flashback and Reflection: From Dormancy to Revival

For years, insurance equities were overlooked on the Nigerian Exchange, plagued by thin liquidity, low profitability, and weak investor trust. But the latest surge is a turning point — a flashback that tells a bigger story of resilience and transformation.

Reforms around recapitalisation, corporate governance, and digital adoption are beginning to bear fruit. Investors are rewarding companies that have embraced these changes, as seen in the strong performance of AIICO, AXA Mansard, Cornerstone, and Prestige Assurance.

Why It Matters

Insurance is more than just another corner of the capital market. It is a critical pillar for risk management, financial inclusion, and economic resilience. The ₦2 trillion-plus insurance industry is expected to play a key role in President Bola Ahmed Tinubu’s ambition of building a $1 trillion economy.

The billion-unit frenzy recorded in this trading session is therefore not just about numbers on a trading board—it is a signal that the sector is entering a new phase of relevance.

Outlook

The road ahead is still uneven. While liquidity and momentum are surging, structural challenges remain in penetration, product innovation, and regulatory compliance. Yet, if the market momentum holds, insurance equities could see a sustained re-rating, transforming them from laggards to leaders in Nigeria’s capital market.

For now, the insurance sector’s powerful trading session is both a flashback to how far the industry has come and a reflection of the opportunities ahead.

Discover more from Ameh News

Subscribe to get the latest posts sent to your email.